Homeowners Insurance in and around Huntingburg

If walls could talk, Huntingburg, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you unwind, wind down and laugh and play. It’s where you build a life with family and friends.

If walls could talk, Huntingburg, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

From your home to your favorite pictures, State Farm can help you protect what you value most. Debbie Allen would love to help you feel right at home with your coverage options.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unforeseen hailstorm damage to your property. Contact Debbie Allen today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Debbie at (812) 683-4348 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

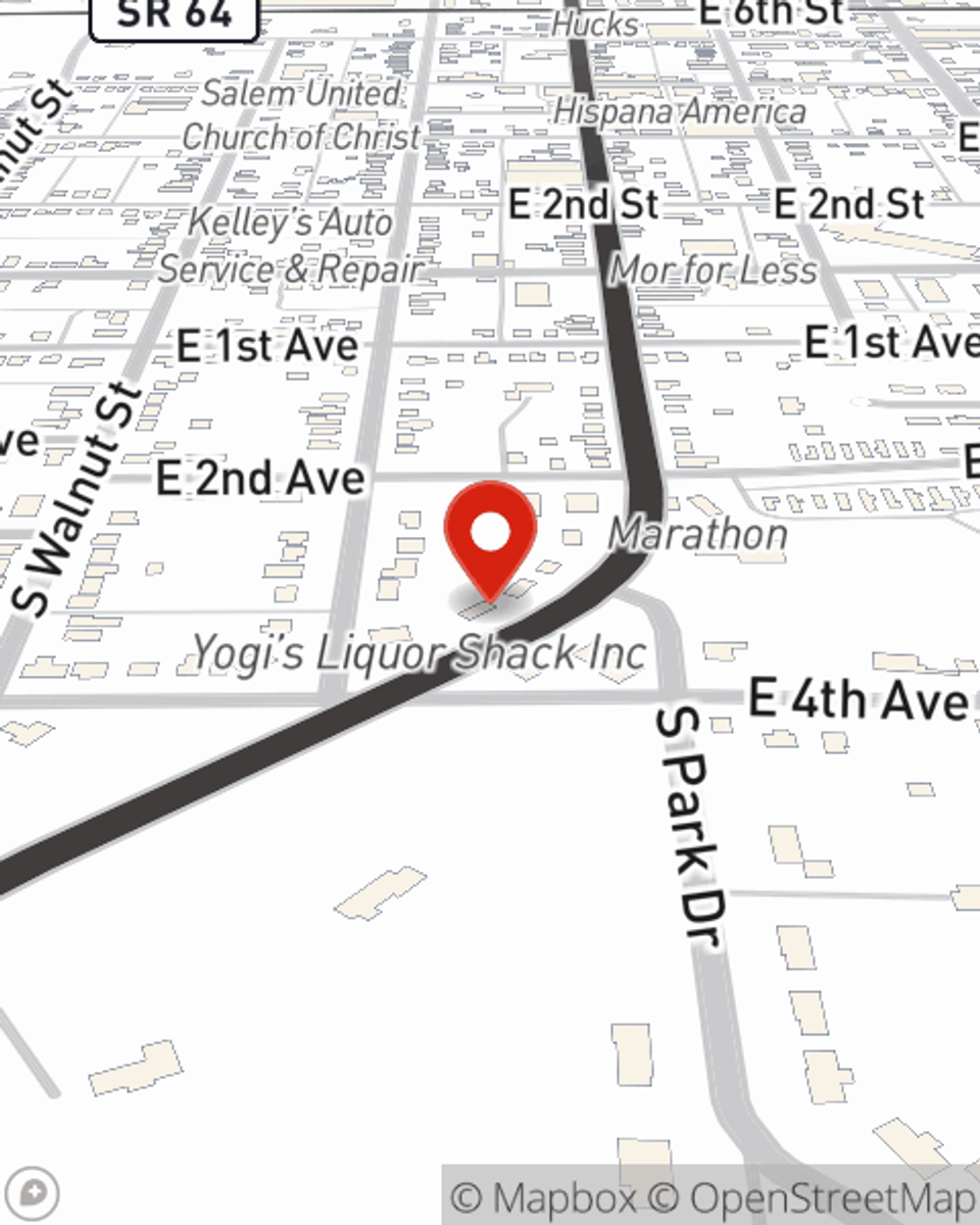

Debbie Allen

State Farm® Insurance AgentSimple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.